A case study using PharmaKB data to explore trending cancer therapies for multiple myeloma and their impact on revenues of existing treatment regimens

Key Takeaways.

- Overall, this case study demonstrates how PharmaKB can be used to investigate changes to the treatment landscape for a particular disease area through identification of newly licensed therapies and their impact on more established therapies.

- These data indicate that, despite multiple factors impacting revenue generation (eg, gain of indications and loss of market exclusivity), the entry of new therapeutics into the market had a direct, quantifiable impact on the revenue generation of more established therapies within a year of their approval.

Introduction

PharmaKB is a drug database that centralizes a broad range of information, spanning clinical, commercial, and financial data, allowing users to form a holistic understanding about the drug or disease area. In addition, PharmaKB helps monitor emerging “Trends” which enables users to quickly gain up-to-date information about changing research for specific drugs and diseases.

PharmaKB was used to evaluate new therapies for patients with cancer between January 2020 and April 2021. Using the US Food and Drug Administration (FDA) 2020 and 2021 Drug Approval Data Sets, several new therapies approved for use over the previous 16 months were identified for multiple myeloma (MM). These therapies included several new technologies (eg, antibody drug conjugates and T-cell immunotherapy) summarized in Table 1.

| Therapy | Initial US Approval | Target/Technology |

| Sarclissa (isatuximab-irfc) | 03/2020 | Anti-CD38 monoclonal antibody |

| Blenrep (belantamab mafodotin-blmf) | 08/2020 | TNFRSF17 antibody drug conjugate |

| Abecma (idectagene vicleucel) | 03/2021 | TNFRS17-directed T cell immunotherapy |

| CD38=cluster of differentiation 38; TNFRS17=tumor necrosis factor receptor superfamily member 17; US=United States Source: PharmaKB, including Sarclissa US PI2, Blenrep US PI3, Abecma US PI4 obtained through links provided within the PharmaKB report. | ||

CD38=cluster of differentiation 38; TNFRS17=tumor necrosis factor receptor superfamily member 17; US=United States

Source: PharmaKB1, including Sarclissa US PI2, Blenrep US PI3, Abecma US PI4 obtained through links provided within the PharmaKB report.

Table 1. New therapies approved for use in patients with multiple myeloma in 2020 and 2021

Assessment of Trending Treatments

The “Trends” section in PharmaKB reports terms that are commonly associated with a particular drug name in PubMed Central, with subdivisions into several categories (i.e., disease or syndrome; pharmacological substance; amino acid, peptide, or protein; cell; and laboratory procedure). Using the pharmacological substance term identified daratumumab, lenalidomide, bortezomib, pomalidomide, elotuzumab, carfilzomib, dexamethasone, corticosterone, asciminib, and pirtobrutinib as being commonly associated in the literature with the new therapies licensed for MM. The National Comprehensive Cancer Network® (NCCN) clinical guideline for MM6 confirmed that most of these therapies (70%) are established as recommended treatments for MM and are used at the same point in the treatment pathway as the recently approved therapies (eg, in relapsed/refractory multiple myeloma [RRMM]). Only corticosterone, asciminib, and pirtobrutinib were not included in the NCCN guidelines; asciminib and pirtobrutinib are investigational therapies as of May 2021.

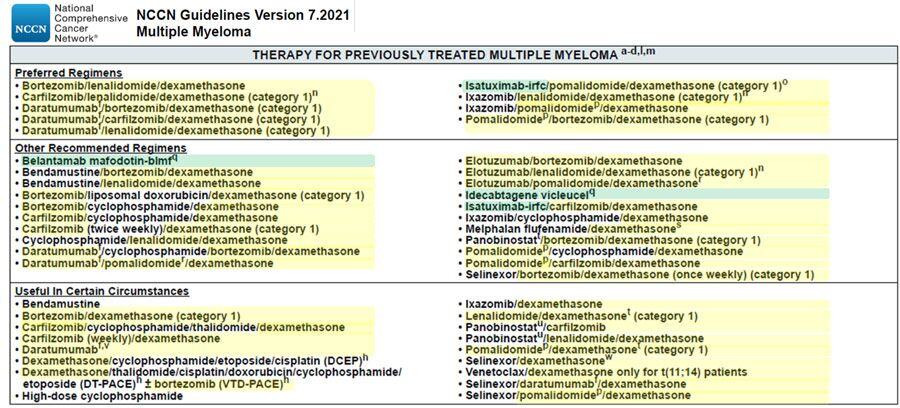

Figure 1 summarizes the NCCN recommended treatment regimens for RRMMidentified through PharmaKB using the approach described above.

Green Highlighting depicts newly licensed therapies for MM identified through the PharmaKB FDA 2020 and FDA 2021 Drug Approval drug sets.

Yellow Highlighting depicts competitor therapies for MM identified through the PharmaKB “Trends” function.

FDA=Food and Drug Administration; MM=multiple myeloma; NCCN=National Comprehensive Cancer Network

Figure 1. National Comprehensive Cancer Network recommended therapies for multiple myeloma

Impact on Revenue

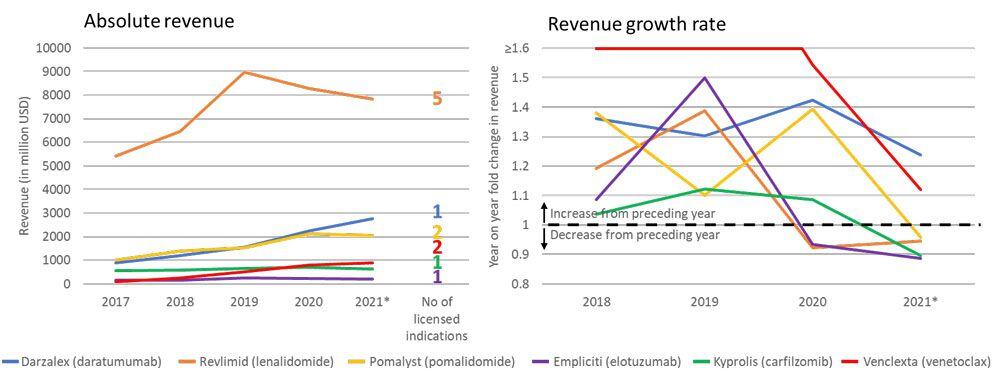

The impact of new MM therapies on the revenue data for more established therapies was evaluated. For therapies with US data available in PharmaKB (carfilzomib, daratumumab, elotuzumab, lenalidomide, pomalidomide, and venetoclax), revenue decreased between 2020 and the first quarter of 2021 except for daratumumab and venetoclax, with both having shown continued growth since 2017, with revenue generally reflecting the number of indications for each product (Figure 1). Revenue growth between 2020 and the first quarter of 2021 decreased or was reduced for all established therapies.

Reported annual revenue for pharmaceutical products listed as a recommended treatment for RRMM in the NCCN guideline for MM for which US revenue information was available in BioHarmony.

*2021 annual revenue figures were estimated from first quarter figures.

MM=multiple myeloma; RRMM=relapse/refractory multiple myeloma; US=United States; USD=United States dollar

Figure 2. Reported revenue of established multiple myeloma drugs

Closing Remarks

Patient survival is strongly influenced by the availability of different treatment options, and it is hoped that the introduction of new classes of treatment for MM will continue the trend for improved survival that has been evident for this disease since 2000. In a short period of time, market forces adjust to adopt superior treatments for Multiple Myeloma.7

Bibliography and Resources

- BioHarmony. www.pharmakb.com

- Sanofi Aventis US LLC. Sarclisa (isatuximab-irfc) US Prescribing Information; 2021. www.accessdata.fda.gov/drugsatfda_docs/label/2021/761113s003lbl.pdf

- GlaxoSmithKline. Blenrep (belantamab mafodotin-blmf) US Prescribing Information; 2020. www.accessdata.fda.gov/drugsatfda_docs/label/2020/761158s000lbl.pdf

- Bristol Myers Squibb. Abecma (idecabtagene vicleucel) US Prescribing Information; 2021. www.fda.gov/media/147055/download

- Oncopeptides Inc. Pepaxto (melphalan flufenamide) US Prescibing Information; 2021. www.accessdata.fda.gov/drugsatfda_docs/label/2021/214383s000lbl.pdf

- National Comprehensive Cancer Clinical Practice Guidelines in Oncology. Multiple Myeloma; Version 7.2021. www.nccn.org/professionals/physician_gls/pdf/myeloma.pdf

- National Cancer Institute Surveillance, Epidemiology, and End Results Program. Cancer Stat Facts: Myeloma. https://seer.cancer.gov/statfacts/html/mulmy.html